About Convr AI

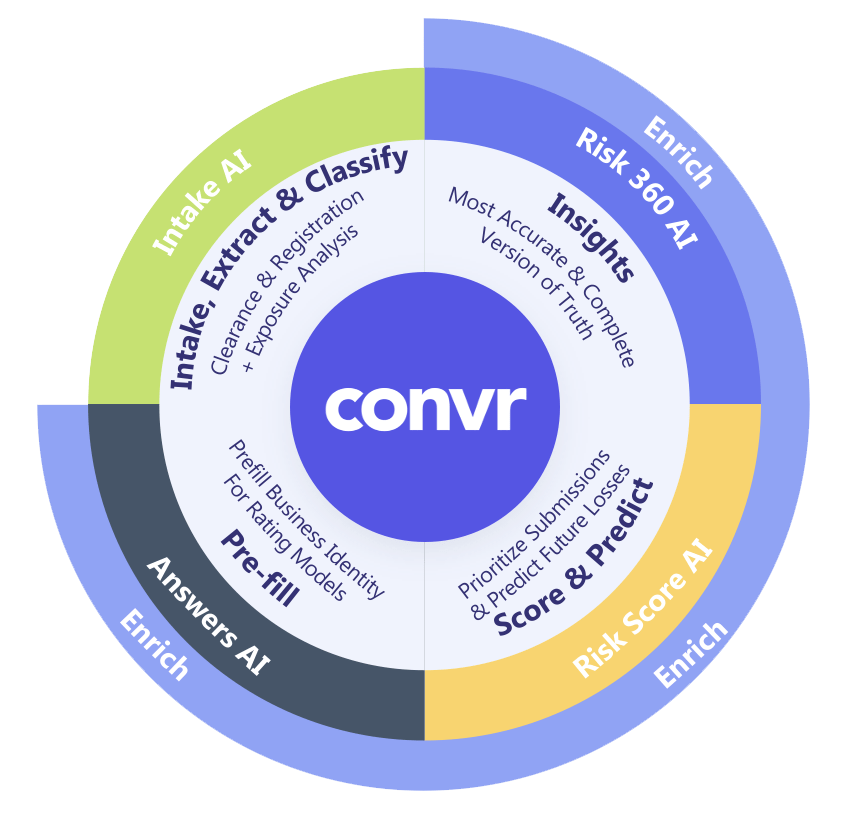

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring.

We help state funds with intelligent document processing (IDP), pre-fill and data aggregation that support your staff by helping them focus on more meaningful work.

Our platform delivers a solution that is reasonably priced, easy to implement and intuitive for new users. We make it possible for state funds to digitally transform their business in just weeks.

We solve the problems of commercial insurance inefficiency, inconsistency and inaccuracy by:

Convr is the only workbench delivering a full suite of AI-infused commercial insurance tools that support underwriting analysis and decisions.

- Real-time fusion of submission data and digital footprint

- Models surface critical insights to drive smarter underwriting decisions

- Quick time-to-value with extensive out-of-the-box features

Overview of Convr AI Risk 360 Data Lake and Historical Snapshots

Thousands of sources continuously updated, with deep lineage and history