Intake AI™

Increase Speed Through Quote Using Intelligent Document Automation

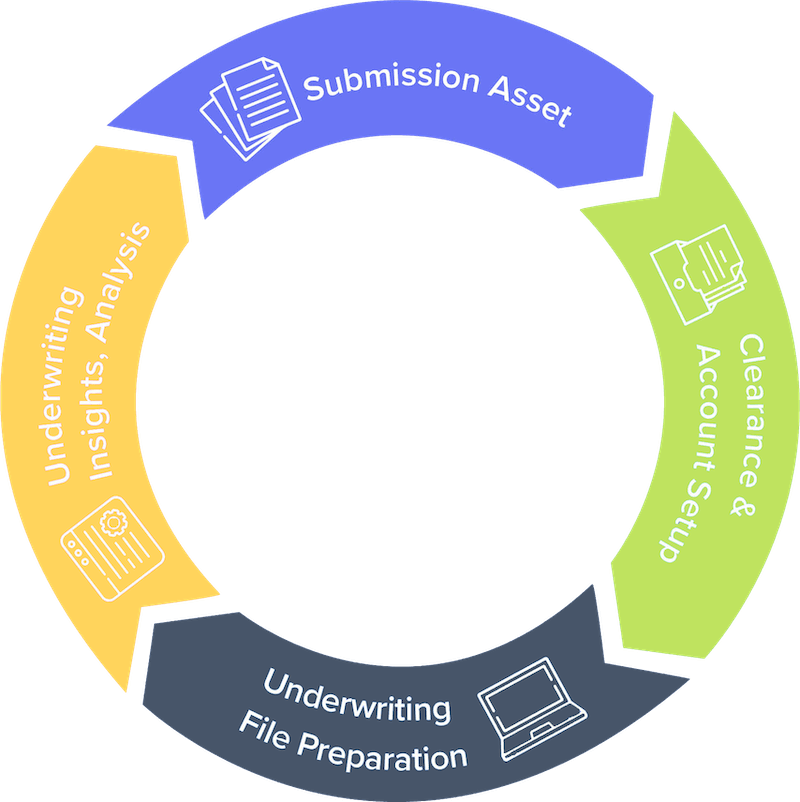

Convr’s Intake AI engine eliminates manual submission processing by digitally ingesting, preparing and analyzing underwriting documents. For every submission that flows through your business we extract key data points and augment the information with third-party data to broaden and deepen the risk profile. By automating and digitizing the insurance application process, underwriting teams quote faster, with more confidence, enhanced application data and achieve more nuanced insights.

Key Capabilities

Drive Efficiency with Straight-through Processing

Ingest, organize and digitally store all your documents in a single Digital Asset Library, including ACORD forms, loss histories and SOVs - virtually any structured or unstructured document.

Avoid Data Leakage

Collect, analyze and retain all the information you’ve captured in the application process to inform future pricing models and decisions. Benefit from consistency of format and data granularity while assuring historical audit compliance and data sharing across departments.

Realize Faster Speed to Quote

Digitize and centralize the submission data extraction process, transforming both the underwriting and customer experience.

Efficient Submission Intake

File Preparation Speed & Accuracy

Getting it right from the beginning is essential for quality outcomes. The initial setup of submission information can come in via paper documents, email, portal and other means. The documents can be structured or unstructured, PDF, handwritten, or typed. Most extraction is fraught with errors, but not with Convr.

Convr Intake AI reads: ACORDs, Loss Runs, SOVs, schedules, financial statements, broker forms, benefits, enrollment, medical and financial claims forms and more. We have an entire team focused on training and tuning intake assets to achieve 97% accuracy.

We are able to ingest, digitize and standardize the information within those files and bring them into a single view, in a single place, into a single format. No more gathering, re-formatting and loading into an Excel workbook. No more cutting and pasting and the inevitable errors!

With Convr, file prep is faster, easier and more accurate – as fast as 30 seconds vs. hours to days for some accounts.

Scores

Commercial Auto

Forecasts risk per power unit in the coming 12 months – combining the number of injuries, accidents and fatalities

Workplace Safety

Forecasts risk per employee in the coming 12 months – combining injuries, respiratory illness, poisonings, hearing loss, and skin disorders and fatalities

Submission Selection & Prioritization

Indicates the relative fit of a submission within underwriting guidelines

Convr at Work

Learn how Tangram Insurance Services drove real results with Convr submission intake

- Increased efficiency by over 130%

- Achieved 91% machine read data accuracy

- Enabled same-day small business insurance quoting

Benefits

Quality Underwriting Experience

Streamline the underwriters’ work experience with more complete and accurate data, clearer insights and heightened decision confidence

Productivity

Prioritize submissions to rapidly narrow risks within appetite and deep dive on selected risks

Speed to Quote

Increase quote-ratios and new business by accelerating the underwriting process from intake to data collection to identifying the right submission questions and answers

Underwriting Efficiency

Drive efficient submission intake, prioritization, underwriting analysis and decisioning with a full suite of AI-infused commercial insurance tools

Customer Experience

Reduce data gathering touch points and the time associated with record retrieval and validation for applicants