Workbench

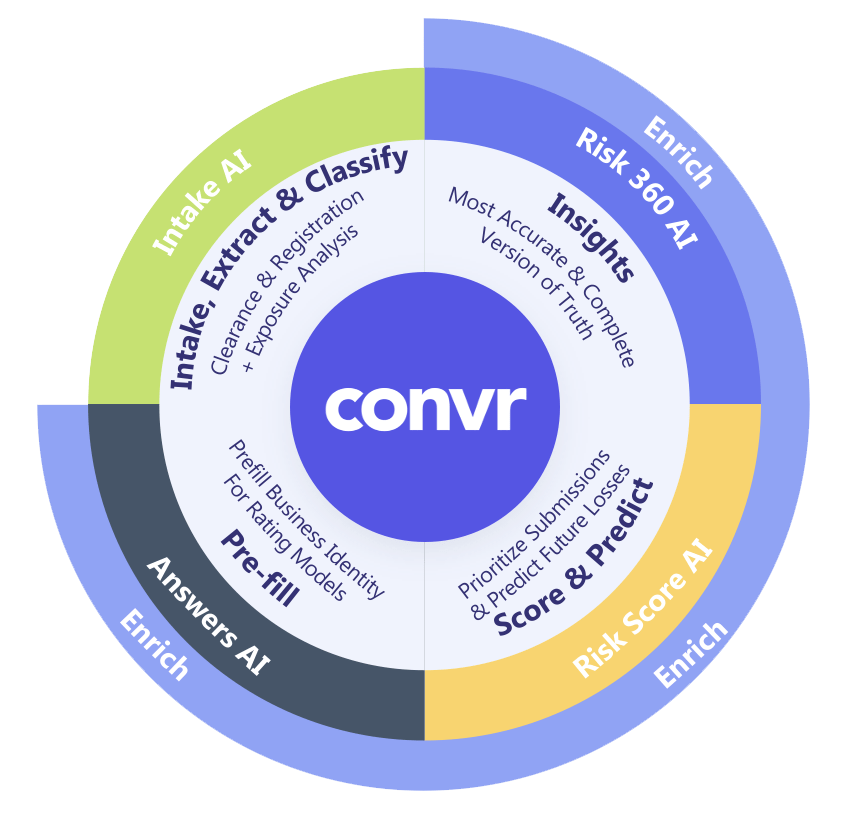

What is Convr?

The Convr Underwriting Workbench can automate the application of your underwriting guidelines with the flexibility to adjust with your experience – so that every new submission or renewal is consistently processed to reflect your risk appetite, both in terms of selection and prioritization.

The business rules framework is fundamental to Convr submission scoring, which is powered by ingested data fused with information housed in the Convr data lake.

The Convr Underwriting Workbench delivers a full-suite of AI-infused agentic tools that support underwriting analysis and decisions.

- Real-time enrichment of submission data and digital footprint

- Models surface critical insights to drive smarter underwriting decisions

- Out-of-the-box features with user friendly AI enhancing workflow with automation

Digitize, Enhance & Expedite Your Underwriting in Weeks

Packages Based on Deep Industry Experience

Essential

No Required IT Integration

- Underwriting Efficiencies

- Data Lake & Document Library

- Federal, State, Local & Firmographic

- Business Class & DBA’s

- Submission Drag, Drop & Edits

- Risk Answers & Snap Shots

Premium

No Required IT Integration

- Underwriting Insights

- Submission Extraction

- Submission Confidence Scores

- Fusion of First- & Third-Party Data

- Source Priority & Clearance

- Excel Rater Templates

Enterprise

Customized Configurations

- Proprietary Underwriting

- Intelligent Document Processing

- Workflow Configurations

- API's & Integrations

- Specialty Data & Risk Scores

- Underwriting Dashboards

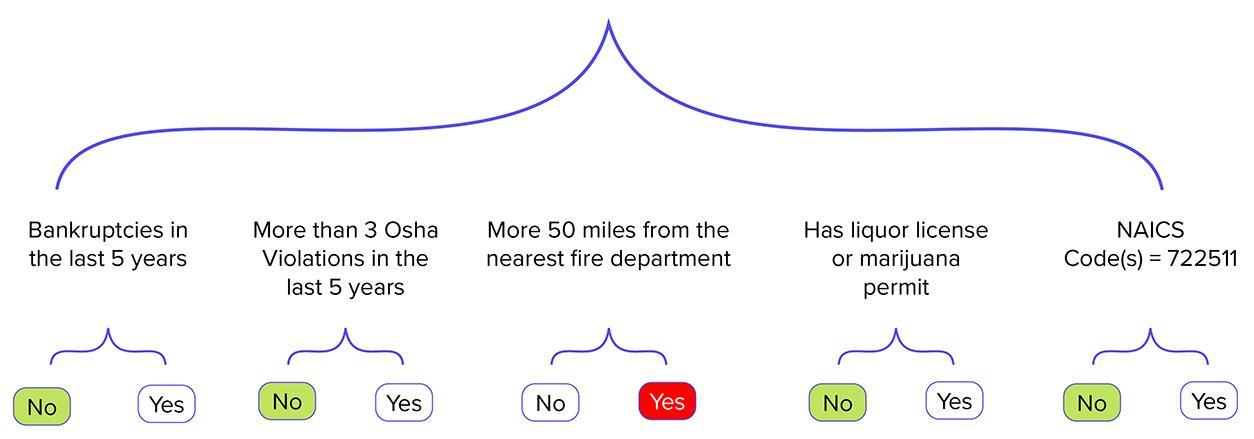

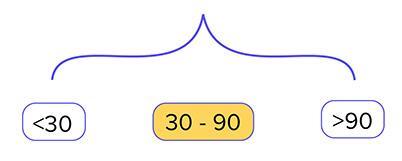

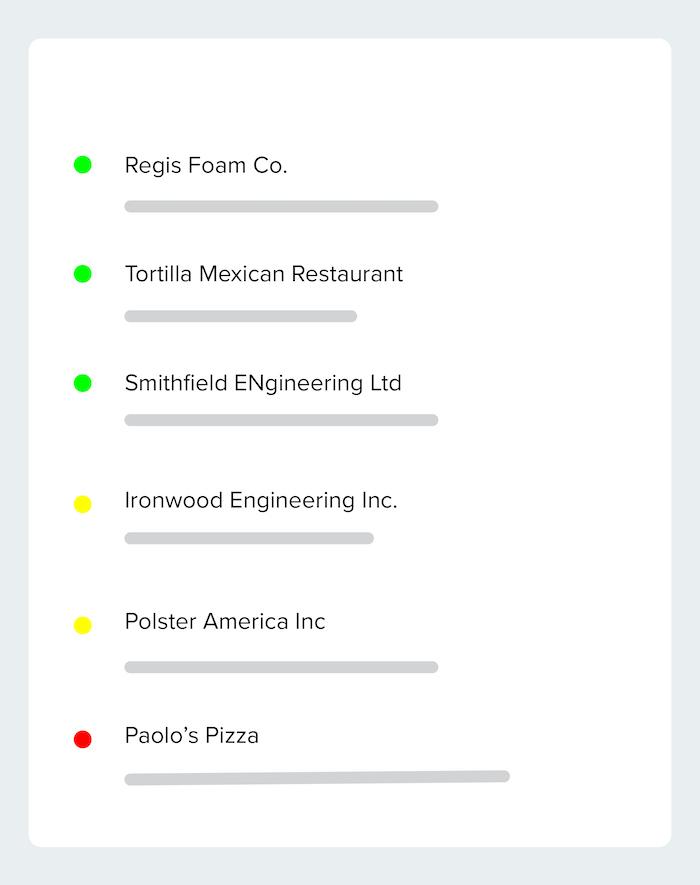

Categorize and prioritize incoming submissions and overlay applicant data with line of business and underwriting business rules

Can be very flexible, customizable and simple based on just two to three criteria

Can be based, in part on any digital footprint information, d3 Answers and/or d3 Risk Scores

Surfacing Answers That Can Lead to Better Selection or Declination Criteria

For examplery purposes