About Us

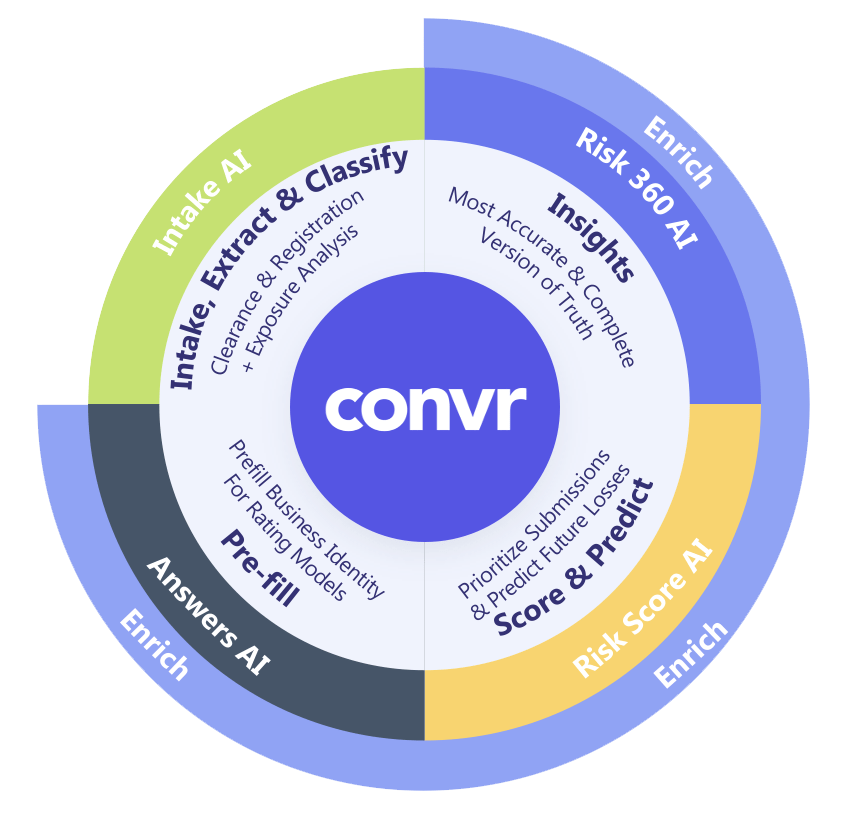

Convr is a modularized AI underwriting, data, and intelligent document automation workbench that enriches and expedites commercial insurance with the best data, underwriting insights, business classification and risk scoring.

Our end-to-end underwriting management workbench delivers superior performance, optimal efficiency and world-class customer experiences to empower commercial carriers, reinsurers, managing general agents/underwriters and producers to digitally transform their business in just 6-8 weeks.

We Solve for Five Problems

Convr is the only workbench delivering a full suite of AI-infused commercial insurance tools that support underwriting analysis and decisions.

- Real-time fusion of submission data and digital footprint

- Models surface critical insights to drive smarter underwriting decisions

- Quick time-to-value with extensive out-of-the-box features

Overview of Convr AI Risk 360 Data Lake and Historical Snapshots

Thousands of sources continuously updated, with deep lineage and history