Modernizing Underwriting:

Turning to Scores

An Age-Old Problem

How do you select the right risk and price it appropriately? That’s the goal of insurance underwriting. There is a delicate balance to charging acceptable rates and maintaining profitability. This is the domain of insurance underwriters who rely on historical data and actuarial analyses to evaluate and analyze the risks.

While the science behind it is valid, little has changed over the years in the way underwriting is performed by commercial insurance underwriters. Every day, thousands of these workers clock into their jobs with the intent to manage risk. They trudge through the mire of imperfect data, old policies, predictive analytics, online information and more to get to a place where they can comfortably accept, avoid or reduce the risk to their company. And why is it so hard? Because no single source is reliable, transparent, or comprehensive for assessing current or future risk.

The very essence of the underwriter’s job is about making the best decision possible for their company, and they don’t want to get it wrong. An inaccurate assessment of the risks associated with writing a policy or from insufficient premium could result in negative impact to loss and combined ratios. But, needless to say, sometimes they make mistakes.

As if this pressure is not enough, the sky-high pile of submissions and staffing shortages are among the many challenges these professionals face. Plus, there are dozens of cumbersome tasks and weeding through voluminous data sets and sources. Old underwriting tools require them to manually key in submission information from incoming documents. And then, the required quality checks contribute to longer lead times and added stress to maintain their high underwriting standards. The pace of work for today’s underwriting professionals is accelerating and the pressure is only getting greater.

Now more than ever, the demand for faster submission processing and improved customer experience has carriers looking for ways to speed submission to quote. Insurance providers want straight through processing (STP) and their customers want real-time answers, quotes, and binders.

Happily, there are new solutions. Convr’s Scores is one way underwriters are expediting their workflow, improving speed-to-quote and feeling assured their decisioning is sound.

Machine Learning (ML) Modeling for Scoring Risks

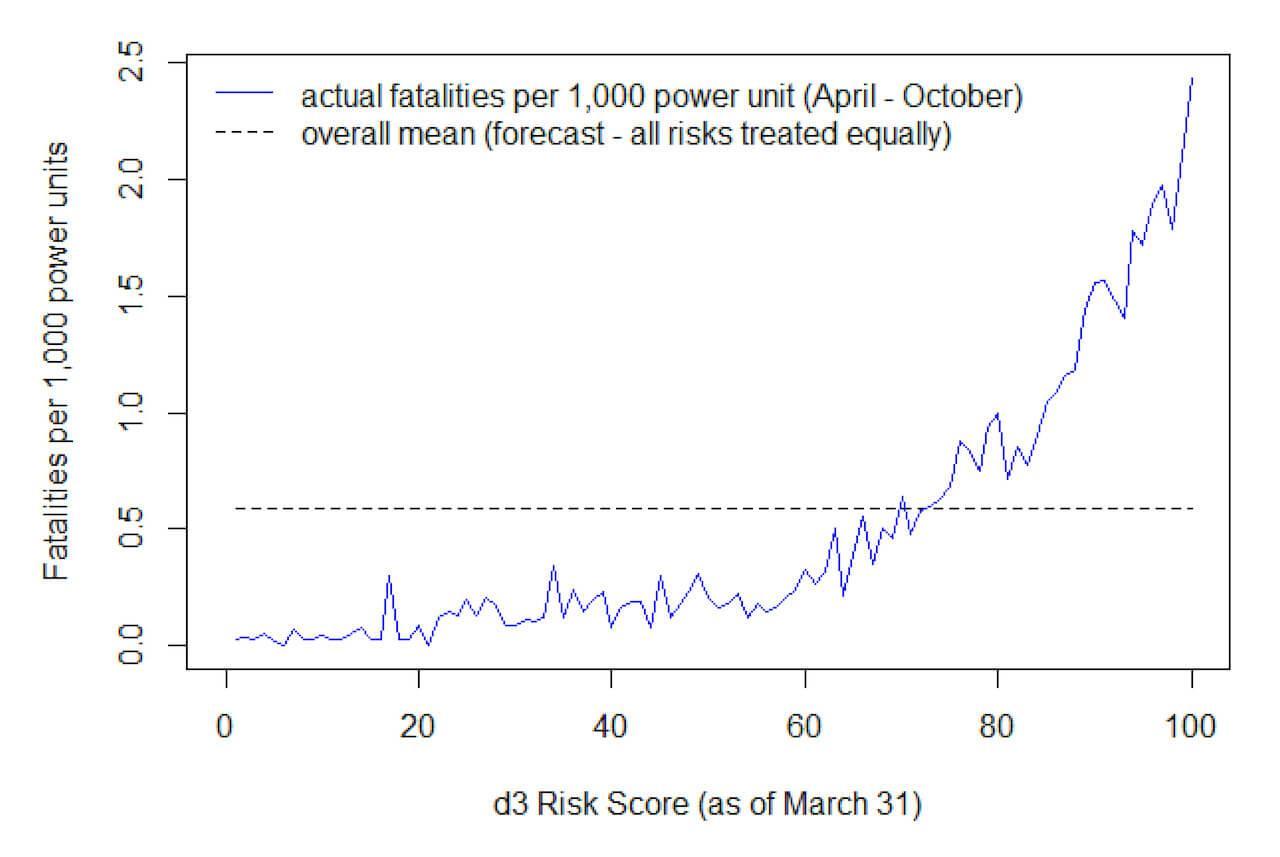

Since 2019, Dr. John Henry, a consultant for Convr and the data science team have been forecasting risk related outcomes one year into the future. This might not seem like a big deal but since most commercial policies have a one-year duration or less, this is enough to provide underwriters with greatly increased confidence throughout the policy term. Examples of the events ML models are trained to forecast include injuries and fatalities.

The team trains the models on recurring schedules to include most recent data, consider new data sources, and improve performance over time. And the findings are presented in an easy-to-understand format – on a scale of zero to 100 called a risk score.

Convr’s patented AI technology leverages ML models that are specifically trained for the commercial insurance industry. These models navigate structured and unstructured data from thousands of data sources and more than four billion data points to verify, cross-reference and deliver critical underwriting insights in real time.

Why Scoring Risks Works

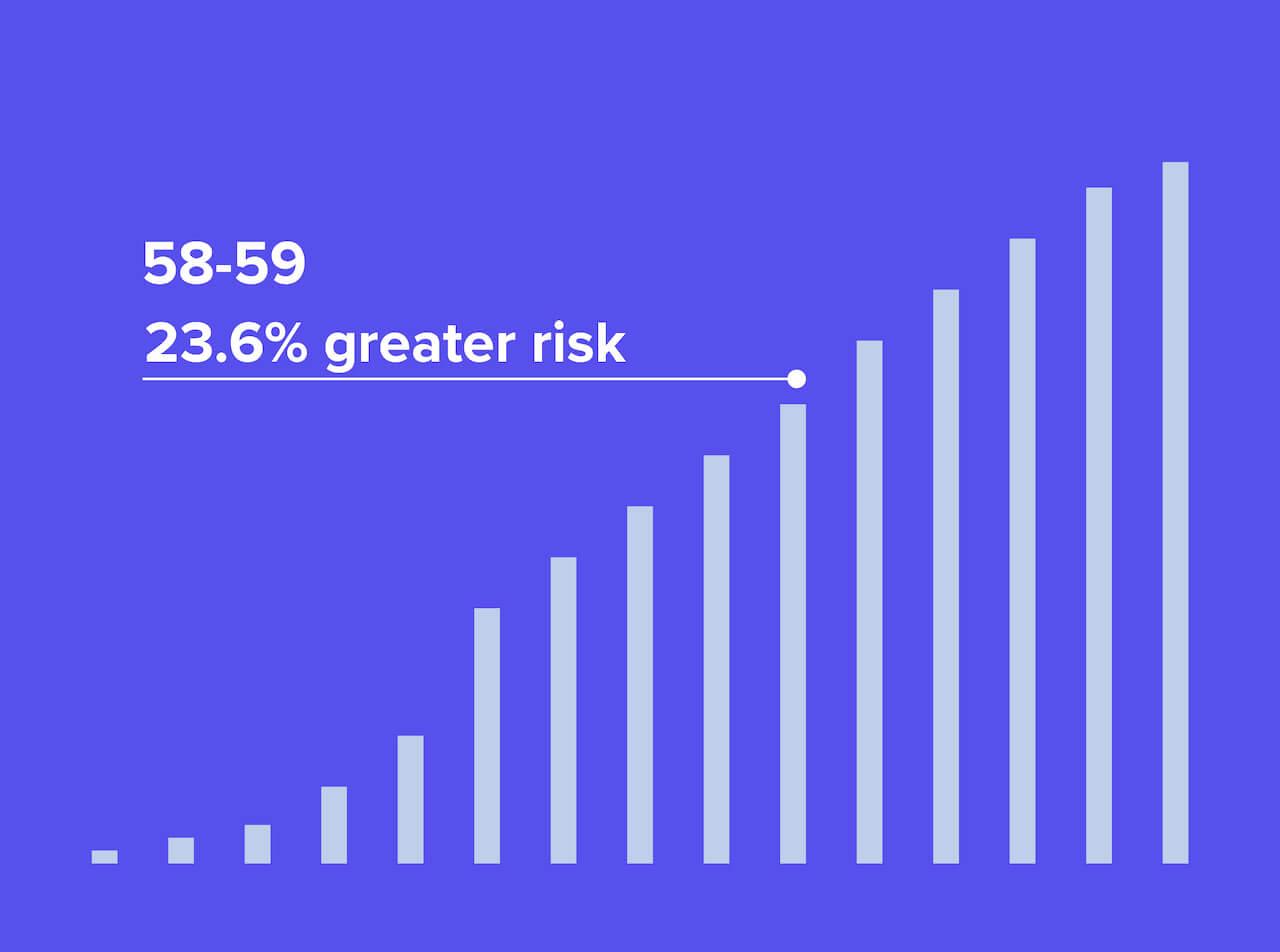

Convr’s risk scoring capability is driven by the need for accuracy and efficiency. Scores upgrade underwriter capabilities by providing the advanced data they need to make better and faster decisions. Convr’s Scores deliver a single number measure of risk for businesses that an insurer can look to and quickly assess the relative risk of insuring a business and prioritize submissions. Companies that return a higher score would be more risky to insure while those with lower scores would likely present less risk.

Risk scoring brings more science and speed to the art of underwriting

For example, an underwriter can quickly see that a score of 90 means only 10% of businesses are more risky, while a score of 30 means 30% of businesses are less risky. The higher the score, the higher the risk. For an underwriter, it is as simple as filling in the name and address of a business and seeing real results that can affirm decisioning.

Scoring Simplified

Scores tell the underwriter where a business is on the risk distribution. A business with a score of 100 means it is in the riskiest 1% of businesses. A business with a score of 1 means that it is in the 1% of least risky businesses.

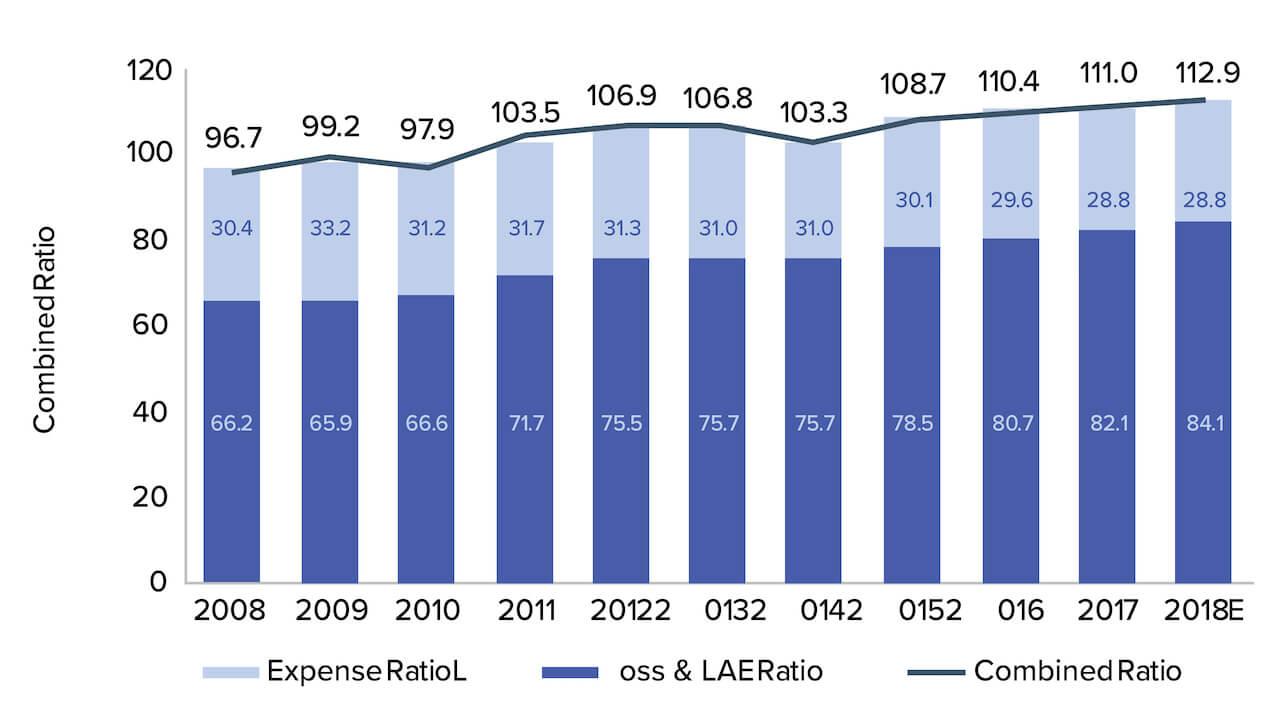

Convr's Data Science team found that underwriting profit in commercial auto had been trending down for several years at the time they began working on commercial auto models. His initial research looked at commercial auto loss experience at the industry level, and preliminary loss models were functions of (mostly) many geotemporal demographic and economic variables. Additional models were trained for commercial auto litigation verdict amounts, and large individual losses.

Dr. John Henry

Consultant, Convr

Source: Best’s Market Segment Report; March 28, 2019

US Commercial Auto

Net Underwriting Performance

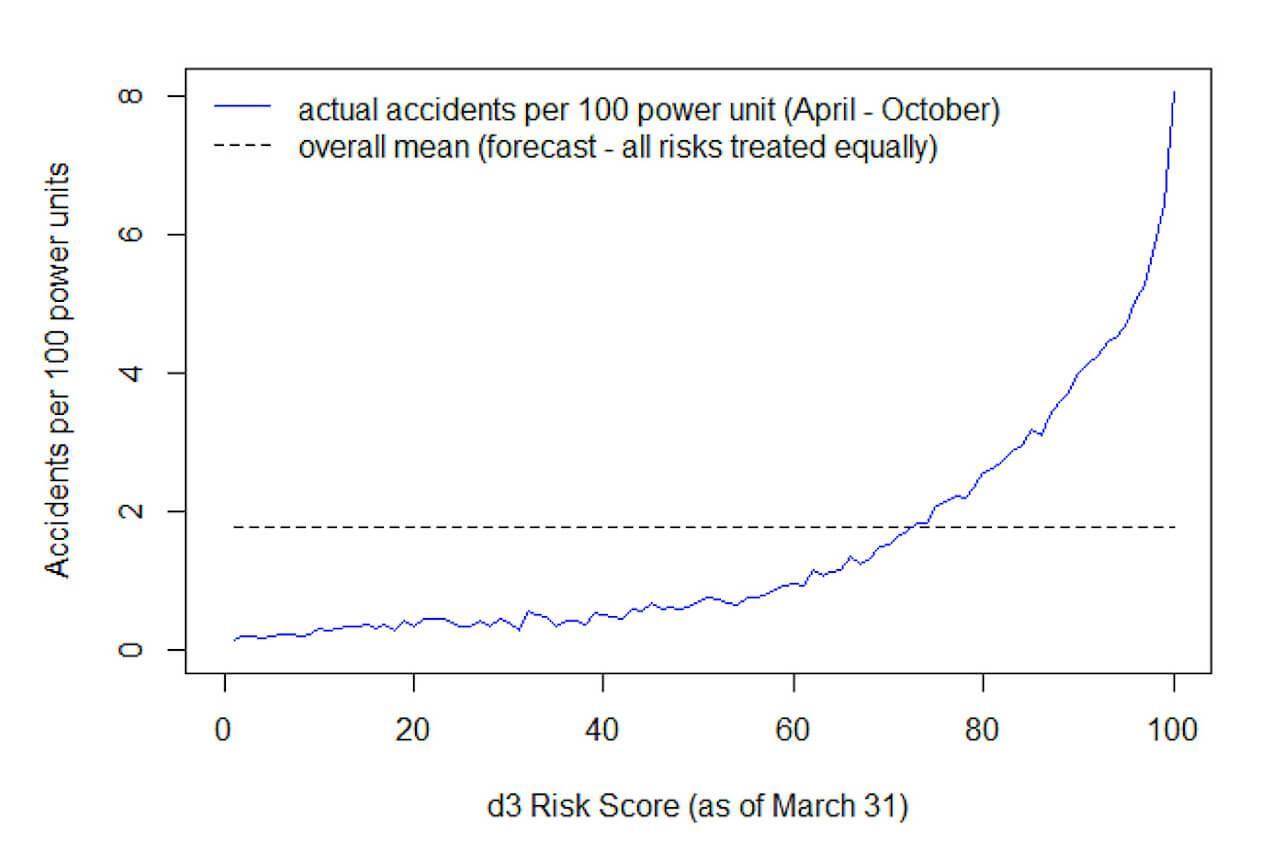

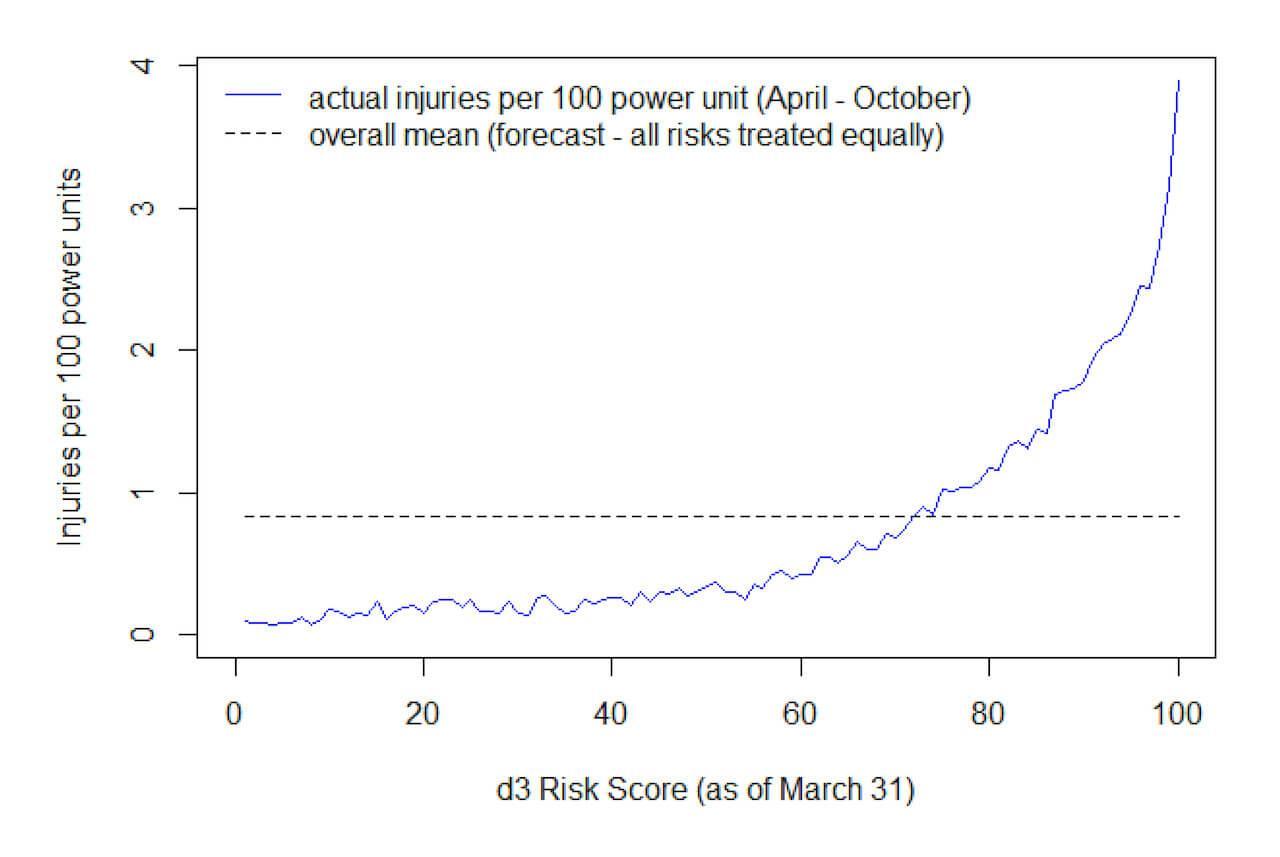

Today, Convr’s commercial auto risk score modeling framework incorporates all these learnings, leverages Convr’s massive data-lake that includes thousands of data sources – updated on a recurring schedule – always forecasting risk one year into the future. In 2022, Convr performed a retrospective study to validate how well our commercial auto risk scoring model was forecasting risk.

See Real Results with

Scores and Risk 360 AI

Increase underwriting productivity

Prioritizing and reviewing submissions is often very manual and cumbersome. With d3 Risk Score, underwriters can rapidly narrow risks within their appetite and deep dive on selected risks via d3 Risk 360 (vs. Google search and DOT/Safer reports).

Reduce underwriting operating costs

Convr’s implementations have seen a material reduction in operational cost across clearance, underwriting file preparation. Automation of these steps have helped our customers lower operational costs (FTE or BPO).

Increase speed to quote

A systematic approach, with d3 Score and d3 Risk 360 reduces administrative burden on Underwriters, reduces time to quote.

See growth of premiums

Increased underwriting productivity and speed-to-quote is expected to drive increased quote ratios, resulting in increased binds/new business.

Calibrate risk selection

Utilizing d3 Risk Score and d3 Risk 360, Underwriters can leverage relevant and timely information on insureds from Convr’s data-lake of 2000+ data sources; high performing d3 Risk Score ML models further inform risk selection – this typically translates to better calibration of risk and greater consistency across the underwriting team.

Pricing adequacy

By monitoring loss performance with d3 Risk Scores, customers can identify segments of their book of business where they have an opportunity to adjust pricing to better reach their target loss ratio.

Dr. Addison Putnam

Consultant, Convr

Why Scores, Why Convr?

To recap, achieving superior underwriting performance with Scores AI and Risk 360 AI can mean a commercial insurance underwriter can make more informed decisions, faster. In this way, insurance providers can realize transformative business growth and success. But, it is important to recognize that true transformation requires more than new technology. You need to be prepared for a shift in organizational mindset and culture, as well as the skill sets and roles of underwriters themselves. This is the secret to true competitive advantage.

As technology continues to transform the insurance industry, you can lead the revolution in your organization by reaching out to Convr. Convr’s AI-infused commercial underwriting platform turbo-charges underwriting with more accurate and efficient decision-making and a greatly improved user experience.

At Convr, we are your partners in defining a new and better vision for commercial P&C insurance underwriting.