November 10, 2022

Convr Streamlining Submission Workflows with Auto-Labeling

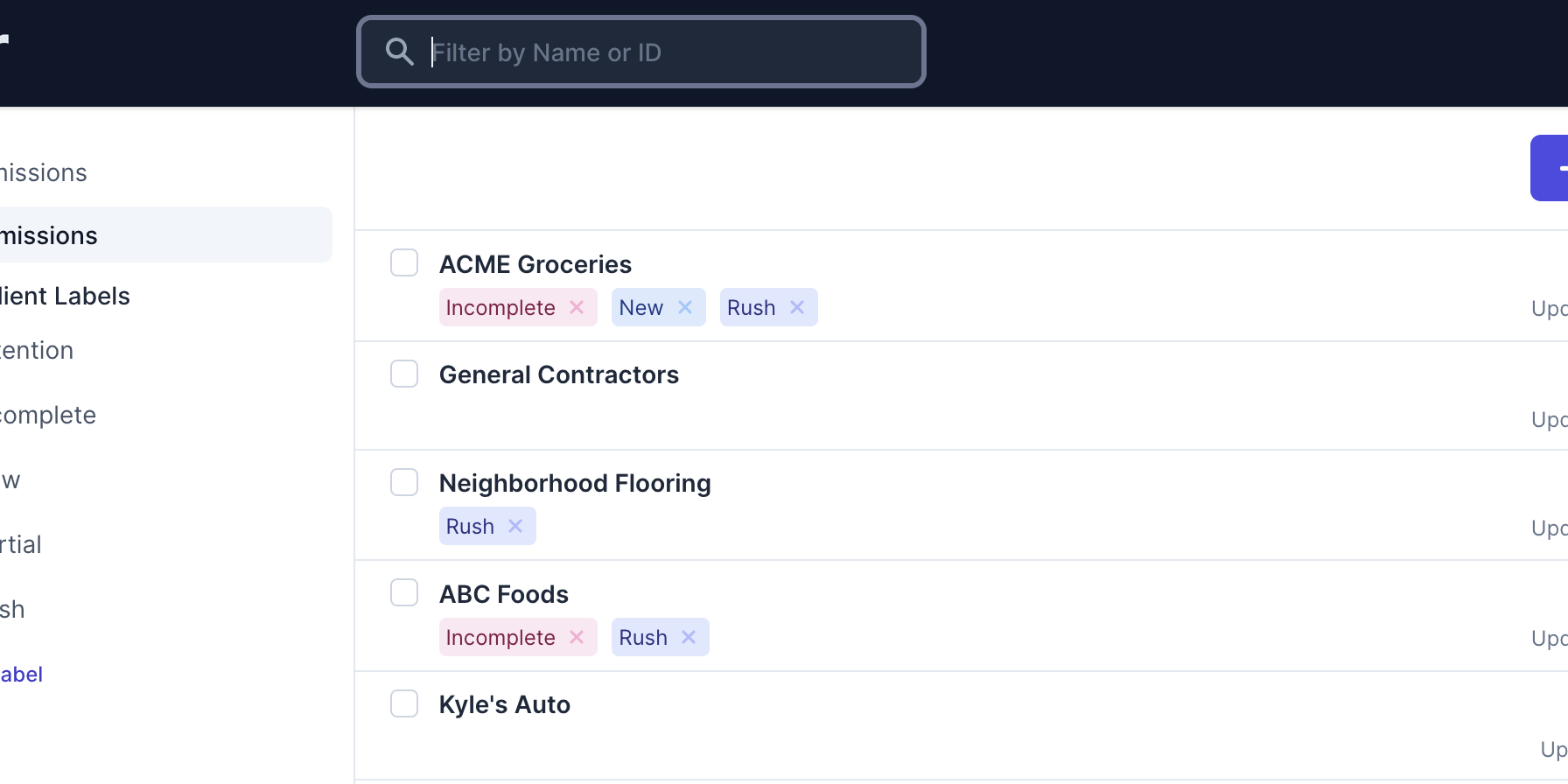

Commercial P&C insurance quoting is getting easier for underwriters who utilize the Convr Command Center. Now, as submissions are received, the Convr platform automatically labels and routes them into separate work queues based on configurable business rules—a process known as auto-labeling.

Convr’s Auto-labeling applies artificial intelligence (AI) to enrich, annotate and label items, allowing users to manually assign user-defined tags to submissions, similar to the user experience of tagging emails in an inbox.

Classifying, sorting, and routing inbound submissions are essential precursors to the underwriting process. Defying the time consuming and labor-intensive tasks underwriting teams often face, Convr’s auto-labeling functionality supports seamless end-to-end workflows, from submission clearance to routing as well as the implementation of business rules specific to a product or team. By leveraging AI, Convr reduces the amount of manual effort required to categorize risks and streamlines the entire underwriting workflow.

How it Works

Auto-labeling extends the Convr embedded AI engine to systematically add tags based on specific submission characteristics. The labels reduce manual effort by eliminating the need for an individual to inspect each submission and route it to the appropriate downstream process. Through our unique auto-labeling system, we’re eliminating unnecessary manual steps for the underwriter, which improves their ability to work smarter and faster as they progress through the underwriting process.

For example — Convr automatically identifies “Rush,” submissions, i.e. submissions that needed a quick turnaround. Convr’s combination of embedded AI, natural language processing (NLP) analyzes the submissions to mark submissions as “Rush” and with the power of auto-labelling, all “Rush” submissions are then automatically prioritized at the top of the queue for underwriting review—expediting the submission.

Hearing Our Customers

Our customers talk about underwriting pain points and we listen. With new algorithms and design, our platform is bettering the way commercial insurance organizations operate and do business. We’re upping the game in insurance by significantly improving efficiency, workflow and automation, and our product keeps getting better.

Even greater functionality is in the works—soon Convr will make these auto-labels individually configurable by end users. Another sign that we’re building the Convr Command Center to be future-proof—built in a way that’s configurable and adaptable to using new technology—adjusting to workflows, configurations and use cases.

Questions?

To learn more about our product development, reach out to Suzanne Vranicar, Business Development Representative at suzanne.vranicar@convr.com