About Workflow

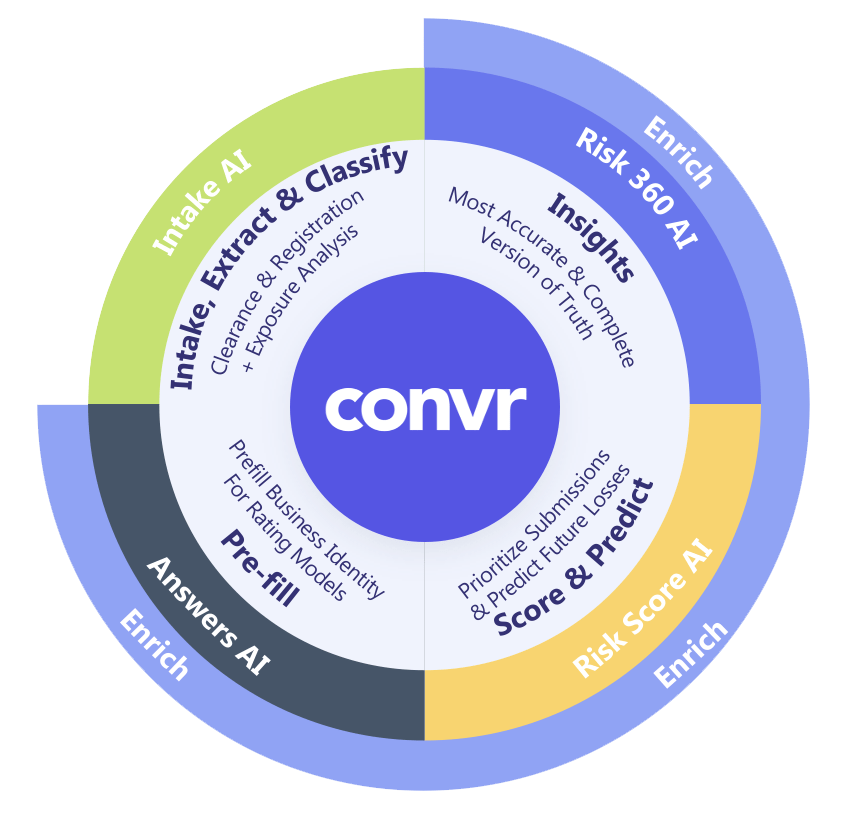

The Convr automated, data-enriching workbench delivers seamless policy lifecycle management from a single pane for improved efficiency and better-informed underwriting with real-time submission enrichment.

Connected Intelligence for Underwriters

The Convr workbench delivers a comprehensive, automated workflow resource that enables insurance organizations to operate within a single risk processing ecosystem for maximum collaborative transparency and efficiency. Our thoughtfully developed user interface (UI) helps underwriting teams – and each individual user – to track and advance submissions with priority labels, status updates, tasking features, assignments, enriched submission view updates, and even team member notification emails. System-generated and custom tasks are available options out-of-the-box. Convr's customers benefit from better decision-making through synchronized workflows.

The Convr Underwriting Workbench delivers a full-suite of AI-infused agentic tools that support underwriting analysis and decisions

- Critical insights drive smarter underwriting decisions faster

- Out-of-the-box features automate workflow processes

- Real-time enrichment of submission data deepens insights

Submission Collaboration for Better Decisioning

Convr AI delivers status-based workflow visibility that automates team member roles, referrals and routing – defined manually or automatically with Agentic AI features. Team members can also add Comments and Notes, Attachments, and Task Reviews with Convr's workflow features.