The Future of P&C Insurance Underwriting:

Technology and Talent Are Reshaping the Insurance Industry

Executive Summary

Insights from Insurance Management on the Shifts Driving Underwriting Performance and Retention

The commercial property and casualty underwriting function is undergoing rapid transformation. As digital tools, automation, and AI reshape traditional processes, commercial property and casualty (P&C) insurance leaders are racing to modernize their teams and technology.

The recent 2025 Convr Insurance Talent and Tech Trends Survey reveals that more than 90% of insurance managers and above are actively up-training their underwriting teams in data analytics, automation, and digital underwriting. Yet despite these efforts, organizations still face significant talent and technology challenges that threaten efficiency, accuracy, and employee retention.

Key findings include:

-

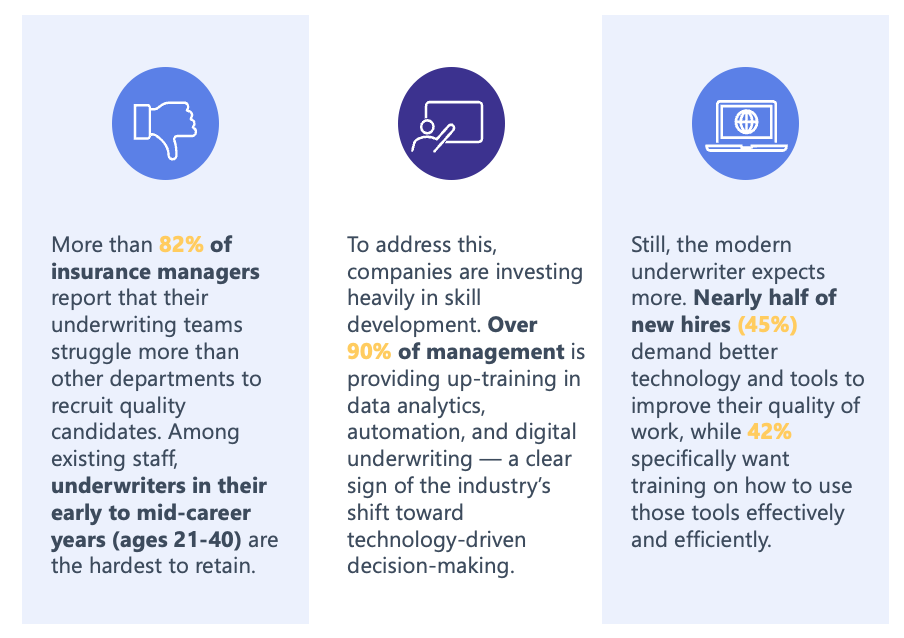

Employee retention risk is highest among underwriters aged 21–40 — the very demographic positioned to lead the industry forward.

-

45% of new underwriting hires request better access to technology and tools, and 42% want training on the latest systems.

-

82% of managers believe their underwriting teams struggle more than other departments to attract quality talent.

-

95% of leaders expect more underwriting tasks to be automated in the coming years, yet manual data entry remains the top barrier to speed and accuracy.

The message is clear: the next era of underwriting depends on smarter tools, simpler processes, and strategic investment in talent.

The Talent Challenge: Retaining and Reskilling the Next Generation

Insurance leaders overwhelmingly agree that underwriting talent can be challenging to find — and even harder to keep.

The takeaway: attracting and retaining the next generation of underwriters requires a dual focus on career growth and technology empowerment.

Technology Gaps Undermine Efficiency and Accuracy

Understaffing and outdated technology are having measurable downstream effects on underwriting accuracy and customer experience.

- 70% of managers believe that understaffing leads to inaccurate information in quotes.

- 82% believe understaffing directly harms customer experience.

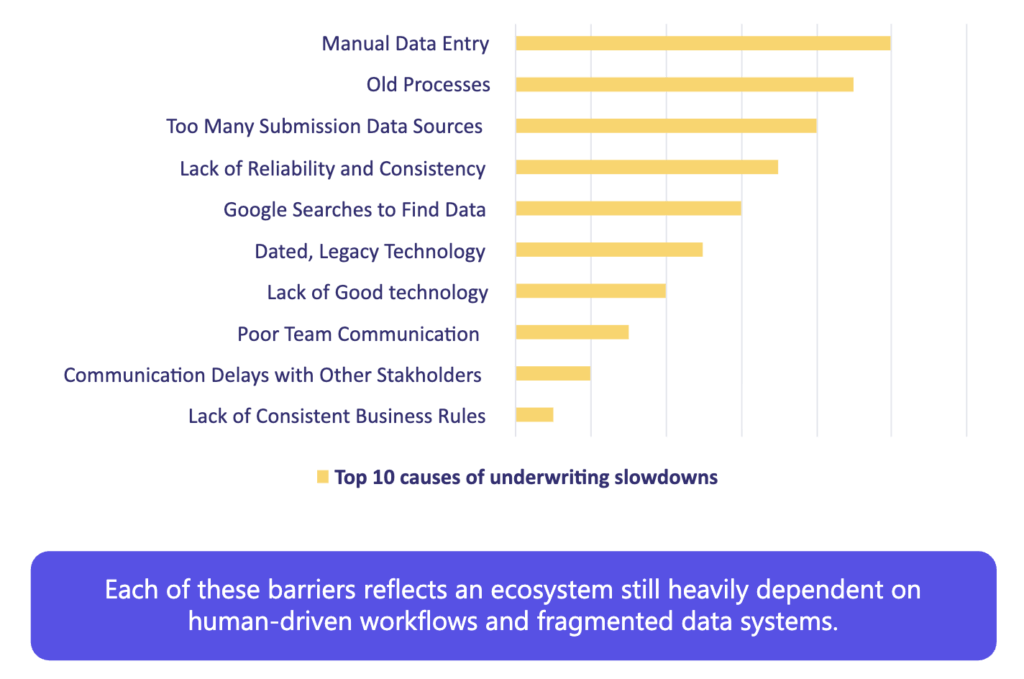

- 56% cite manual data entry and collection as the number one issue slowing down underwriting operations.

In fact, managers ranked the top 10 causes of underwriting slowdowns as follows:

The Automation Imperative

Nearly 95% of insurance leaders expect a higher percentage of underwriting tasks to be automated over the coming years. In fact, more than 80% believe that at least 25% of today’s manual underwriting work could be automated.

The potential gains are substantial. One Convr customer reported reducing quote turnaround time from 1-2 days to just nine minutes after implementing automated underwriting workflows – a testament to the power of automation and intelligent data ingestion.

For an industry still battling staffing shortages and data bottlenecks, automation represents not just efficiency — but sustainability.

Technology as a Retention Strategy

Better technology doesn’t just improve productivity — it improves retention. 84% percent of insurance managers believe that upgraded tools and automation will probably or definitely reduce employee attrition.

As one senior underwriting leader noted, “When we remove the repetitive, manual work underwriters can focus on what they actually trained for — risk assessment and decision-making.”

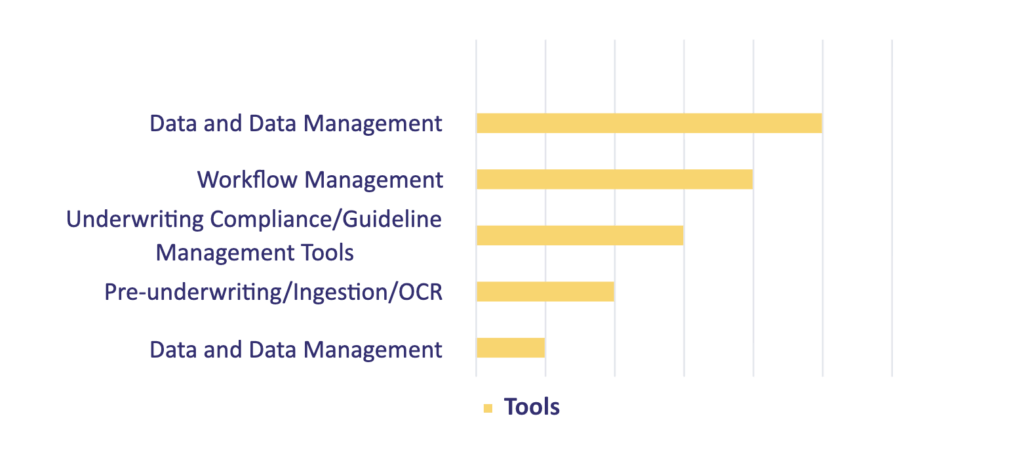

Technology investments are already accelerating. 73% of companies delivered new underwriting tools to their teams in 2024, and 83% plan to deliver more in 2025.

When asked which tools have the most impact, managers ranked the top five as:

This hierarchy highlights a clear emphasis on data visibility, compliance, and automation — all key to modernizing underwriting at scale.

What Underwriters Need Most

Respondents indicated that their underwriting teams would benefit most from simplified access to critical resources. In rank order, they cited:

Simplifying access to this information — and integrating it into daily workflows — is essential to improving accuracy, speed, and employee satisfaction.

Top Skills for the Modern Underwriter

Even as automation grows, the human element of underwriting remains central. Commercial P&C insurance managers identified communication, detail orientation, and decision-making as the top three skills they seek in underwriting team hires.

Even as automation grows, the human element of underwriting remains central. Commercial P&C insurance managers identified communication, detail orientation, and decision-making as the top three skills they seek in underwriting team hires.

These “power skills” complement automation by ensuring underwriters can interpret, validate, and communicate insights from digital tools effectively.

A Vision for a Smarter, Faster Underwriting Future

Nearly 95% of underwriting management agrees that their company’s performance could improve through greater efficiency in underwriting processes. This consensus underscores a critical opportunity: to unite people, process, and technology in a cohesive digital strategy.

The path forward involves:

Automating routine work such as data collection, entry, and validation.

Modernizing workflows through integrated data sources and workflow management systems.

Training underwriters on AI tools and analytics to support faster, more accurate risk assessment.

Improving data quality and accessibility to eliminate guess work and manual searches.

Investing in experience – ensuring underwriters have tools that make their jobs easier, faster, and more rewarding.

Conclusion

The commercial P&C insurance underwriting profession stands at a turning point.

While challenges in talent, staffing, and technology persist, the industry’s direction is unmistakable: digital transformation is no longer optional — it’s a competitive necessity.

As automation expands and data becomes more central to decision-making, insurers that prioritize technology, training, and employee experience will not only operate more efficiently but also build the kind of workplaces that attract and retain top underwriting talent.

The future of underwriting isn’t about replacing human expertise —it’s about amplifying it through technology.