June 10, 2025

Younger Workers Turning Down Underwriting Roles Lacking in Tech and Remote Status

Results Are In in Convr AI® Insurance Talent and Tech Trends Survey

CHICAGO (June 10, 2025) – Remote work trends versus Return to Office (RTO) protocols could be the tipping point for commercial property and casualty (P&C) insurance providers in securing top insurance industry talent in 2025. Plus, add to the mix access to current technology and hiring woes could be in a death spiral for underwriting teams.

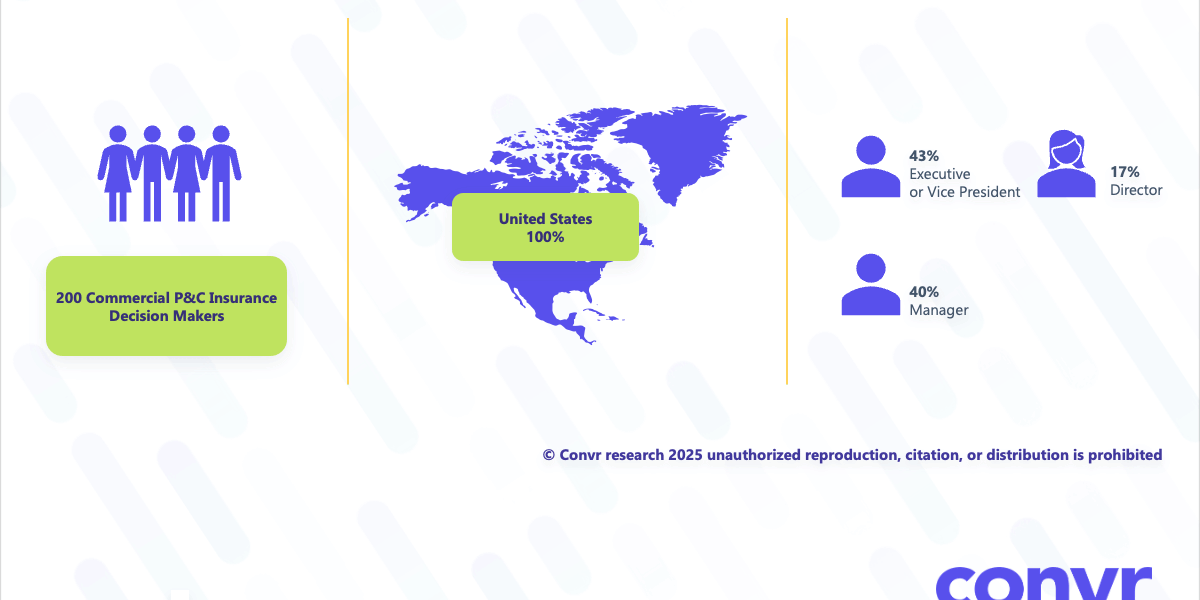

In this year’s Convr Insurance Talent and Tech Trends survey, Convr surveyed 200 commercial property and casualty (P&C) insurance decision-makers across the U.S. to dig into the role talent and technology play in driving results.

What we discovered? Leaders in the insurance industry across departments ranging from underwriting, IT/analytics, finance and more recognize they are having a hard time recruiting underwriting talent at all levels with those ages 41-40 and 21-30 being the hardest to hire. Similarly, those in those same age ranges are the hardest to retain on their underwriting teams.

There’s good news, though – to build teams with younger generations, 73 percent of leaders say most to all underwriting positions have the option of being remote, while only 8 percent say none of their open underwriting roles have that potential. And that’s what this generation of workers is after – those polled said greater flexibility on how to do the job mixed with better access to technology and tools to improve quality of work are requested most often by new underwriting hires.

But not listening to their underwriting workforce could come with a cost as 82 percent of those polled said staffing limitations are negatively affecting their growth and/or expense ratio and that underwriting remains the area where quality candidates are harder to come by. As a result 72 percent of respondents claimed understaffing has led to inaccurate information informing their quotes and 83 percent attribute understaffing to more negative customer experiences.

And believe it or not, company performance suffers! Some 95 percent of respondents agreed that their company’s overall performance could improve with process efficiencies in underwriting. Meaning leaders should be primed to adopt the tools necessary to do the work in a remote setting to more broadly appeal to the younger generations that are turning down their on-site jobs.

That is where Convr shines! As it turns out, 93 percent of those polled agreed that using current technology helps attract younger workers. And our innovative and modular workbench solution enables underwriters to be nimble and cuts back on manual data entry that is bogging down so much of the process according to 34 percent of those surveyed. The next highest categories that could use some improvement were old processes at 28 percent and too many submissions at 24 percent.

But these are not just nice-to-know findings; these are action items. They are a fundamental shift in how commercial P&C insurance organizations should be thinking about their tech stack and hiring strategies. And Convr can help, reach out to get a demo today: https://convr.com/about-us/contact/.

About Convr®

Convr is a modular AI underwriting, data, and intelligent document automation workbench powered by a commercial P&C insurance ontology that enriches and expedites submissions decisions with the best data, insights, business classification and risk scoring – reducing submission through quote times by 70%, increasing new business win rates, and quickly identifies renewal material changes. To learn more, visit convr.com. Follow Convr on Twitter, Instagram, LinkedIn and YouTube.